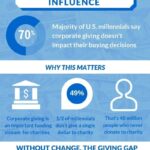

In the current economic environment, smart giving requires the same carefully constructed, strategic thinking that we apply to the rest of your finances. Even during the recession, almost half of all donors made gifts at the same level as in years past, with 26 percent of donors actually increasing their gift levels.* We need to be sure your philanthropic efforts are aligned with your other financial strategies so that charitable aspirations aren’t fulfilled at the expense of important objectives, and vice versa.

Most people practice a form of “checkbook philanthropy,” which involves simply writing checks regularly to a particular organization, or randomly in response to requests from multiple organizations and individuals. While donating cash is simple and straightforward, it doesn’t always offer optimal tax advantages. Donating appreciated securities — instead of selling the securities first, paying capital gains tax and then contributing the proceeds — may be a better alternative. If the charity sells the stock after it receives the donation, as a tax-exempt organization, it will not pay tax on the capital gains triggered by the sale.

Charitable giving vehicles

Besides what to donate — cash, securities or tangible assets like cars and art — another major issue to consider is how. You may choose to give to charity outright or donate through a charitable vehicle, such as a donor advised fund, private family foundation, charitable trust, gift annuity or pooled income fund. All offer various tax benefits but differ in their structure and administrative requirements. Three of the most common are: