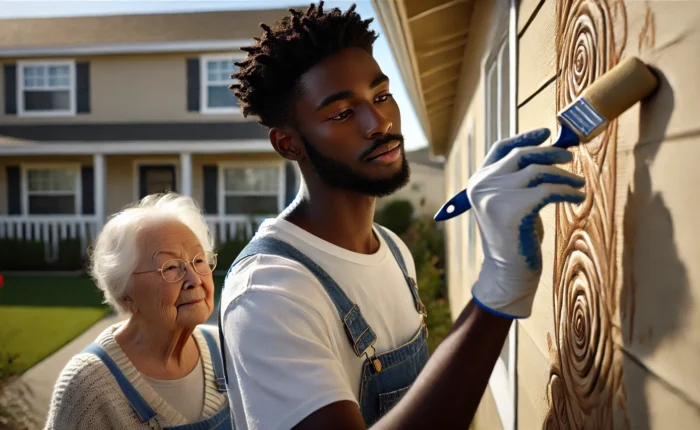

When Carol Nash retired four years ago from Dimensions Healthcare System in Maryland after a long career in nursing, she had no inkling that she would soon be working harder than she ever did before.

But Ms. Nash, 70, is fine with that. “I burn with a passion for what I am doing,” she said. “If I can make the difference in the life of one child, then I believe I have fulfilled a purpose here.”

In 2012, Ms. Nash founded a small nonprofit, Bernadette’s House, based in Laurel, Md. The organization provides early intervention and prevention services through an after-school mentoring program for girls 10 to 17 at risk of teenage pregnancy, drug addiction or failing in school.

“Helping people is what I’ve done my entire life,” she said. “I guess I’m not really retiring.”

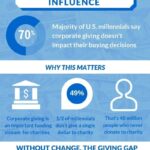

She represents a growing and potentially historic force in philanthropy: the retiree giving boom. A new Merrill Lynch study conducted with Age Wave, which does research on the aging population, projects a potential giving surge in the United States over the next two decades of some $8 trillion, a sum swelled by the baby boom generation and increasing life expectancy.

Many are devoting their retirement to volunteering or, like Ms. Nash, starting small charities. Some are increasing donations to causes they care about through planned giving strategies.

This huge transfer of wealth is happening during a much larger transfer of wealth as the older generation dies off. According to a report from researchers at the Center on Wealth and Philanthropy at Boston College, from 2007 to 2061 an estimated $59 trillion will pass to younger generations from estates. Heirs will get the most, some $36 trillion, but charities stand to receive trillions from bequests, the report says.