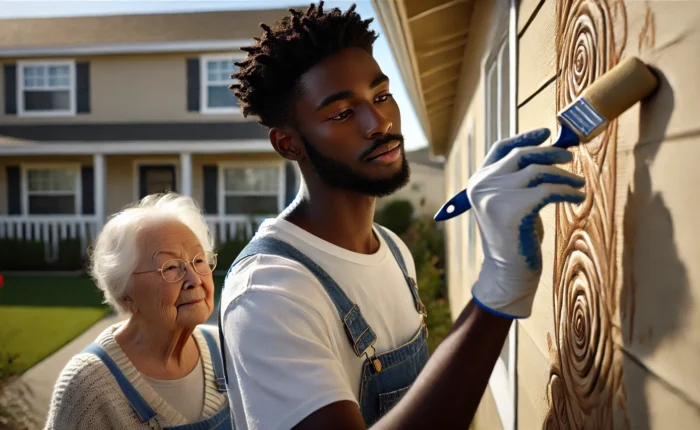

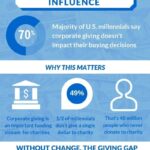

One of the great privileges of running a small business is being able to give generously to community organizations and charitable causes that matter to you. Every day, small business owners share their success by giving money, products, volunteer hours and charitable outreach efforts to good causes in their communities. Nonprofits and charities are constantly looking for funding to help accomplish their goals, and giving to these organizations is not only a good thing to do – it can also deliver big benefits to your business. We’ve written before about how generosity is the new marketing: in the social media era, companies that give generously will earn a reputation as being “good” companies, and people will be more likely to want to buy from them. For example, many restaurants set aside special occasions to feed the homeless for free – not only is this a wonderful, generous act of kindness that is core to these restaurant owners’ missions, but it’s also providing excellent publicity for the restaurants by showing the community that these restaurant owners really care about the less fortunate. By supporting a charity, your business is spreading the word about your values and intentions, and helping you get introduced to new customers who are involved with the nonprofit organization. But how do you know which charity to support? How can you get the most mileage out of your charitable donation – both in terms of the charity’s positive impact, as well as the value of the partnership and publicity for your business?

Here are a few ways that supporting a charity can be helpful to your small business:

Tax Deductions One of the most immediate benefits to your business from supporting a charity is being able to get a charitable donation tax deduction. Donations that are generally tax-deductible include sponsorships of charities or events, donations of inventory or services and cash donations. In general, you can get deductions on charitable donations of up to 50 percent of your Adjusted Gross Income – but be sure to follow the rules closely to avoid any tax problems. You might be able to claim your charitable contributions and some volunteering expenses as charitable contribution deductions on your income taxes. By itemizing your deductions, you can write off the mileage driven to and from volunteer work, as well as the cost of materials purchased for volunteer projects. You can also get a tax deduction for the monetary value of charitable donations – whether it’s cash, stock or even used vehicles. But make sure you are working with anonprofit organization that is approved by the IRS. And in order to get your tax deduction, the charity or nonprofit will need to issue you a tax form that you can file with your tax return. Depending on your income and other factors, giving money to charities can be complicated – so talk to your accountant or tax adviser for more specific advice on how to maximize your charitable giving while minimizing your tax bill.Many small businesses try to make charitable giving part of their overall business model. For example, many small businesses sell products where a certain percentage of the sales go to charities that they support. April Leffingwell, founder of SHEA Chic Boutique, donates to many animal charities and advertises these donations on her company website. When customers see the charitable impact of buying from a small business that supports the community or gives to causes that matter to them, they will be more likely to buy from your company instead of from a more anonymous big brand that doesn’t have that same human connection.