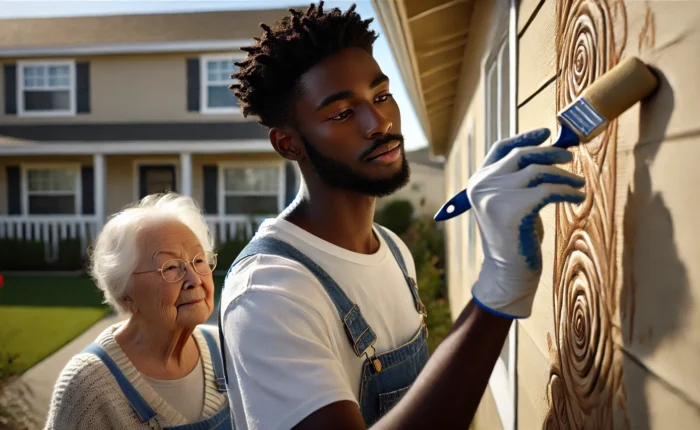

Giving is truly better than receiving, especially when your generosity can provide income tax benefits.

There are a lot of good reasons to make donations to charity, but most boil down to one simple fact: Giving feels good. It’s no surprise, then, that many Americans give money or property to organizations they care about. In fact, some give quite a bit.

Cross your t’s and dot your i’s

Whether you’re a minor donor or a philanthropist, you probably give because you want to help. Still, taking maximum advantage of tax breaks for your charitable efforts can make a difference to your bottom line—and involves following some fairly straightforward rules for deducting your donations:

- Itemize deductions. To claim charitable donations on your tax return, you need to itemize deductions on Schedule A. Before making this move, be sure that itemizing will reduce your tax bill more than taking the standard deduction. If you use TurboTax, we’ll figure your taxes both ways and tell you whether itemizing or taking the standard deduction will give you the biggest tax benefit.

- Keep proof of your gift. If you gave cash, hold on to a bank statement, cancelled check or credit-card receipt showing the amount of the donation. For gifts of cash or property worth more than $250, also keep the written acknowledgement from the charity showing the date and value of the donation.

- Clothing or household items must be in good shape. Second-hand clothes and the like must be in at least “good used condition.” You can deduct only the value they would sell for in a thrift shop—not what you paid for them. To help you keep track of this information, TurboTax has a tool called “ItsDeductible” that uses eBay to calculate the IRS-approved value of your donations of things like used clothing, coffee makers, toys or bicycles. You’d be surprised by how much these gifts can add up.

- Fill out form 8382 when you deduct gifts of items worth more than $500. (TurboTax will do this for you.)

- Get an independent appraisal when giving valuable property. When you claim a donation of furniture, jewelry or other item worth more than $5,000, the IRS wants independent verification of its value.