If you don’t wear a top hat and a monocle on a regular basis, you probably don’t know what a Donor Advised Fund is. A Donor Advised Fund is a great tool to claim a tax break for your charitable giving. Usually used by high net worth individuals, a DAF is an account that can be pre-funded to be used for charitable giving at a later date (up to 4 years from funding). So if you know you are going to be giving away money this year, but don’t know to whom, and are afraid you’ll forget to claim your donation when the tax man comes knocking, then you need a Donor Advised Fund.

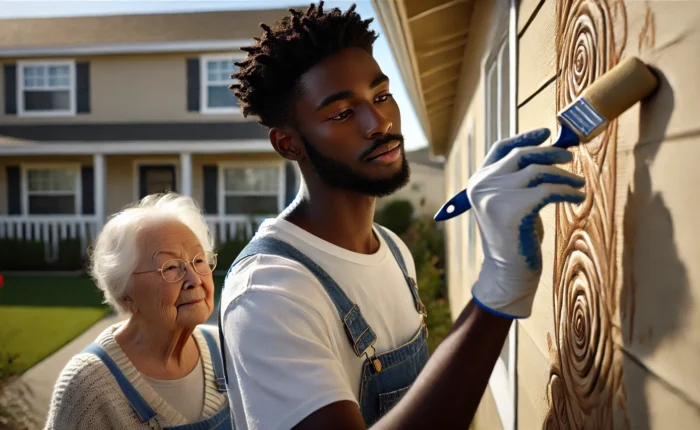

“OK. So what?” you’re thinking. But what if, your boss walked into the room (wearing his top hat and monocle) and handed you a $1000 bill. There is only one catch…you have to give it away to a charity. OK. Sure. You’d rather have that money in your bank account, but that’s not the spirit of this game. You HAVE to give it away. So, you choose your favorite charity (maybe The American Accupuncture for Snakes Foundation), the one that means the most to you for whatever reason, and you hand them the $1000 bill. The charity is helped and you feel good, right?

Well guess who else benefits? Your boss. Hell, he was going to give that money away anyway. He does every year. Sometimes his company name is on a banner, or in really good years, it might make it onto a t-shirt (hooray). But do his employees care? The answer is yes, sorta.

What if your boss gave all of you a Donor Advised Fund and pre-funded it with the money he was already going to give away? Now, instead of having his logo on a vinyl curtain somewhere, he can engage his employees by letting them give away the company’s money to charities that the employees care about.

Whoopee! Boss is happy (tax credit claimed) and the employees are happy (they get to make a difference in their communities)!